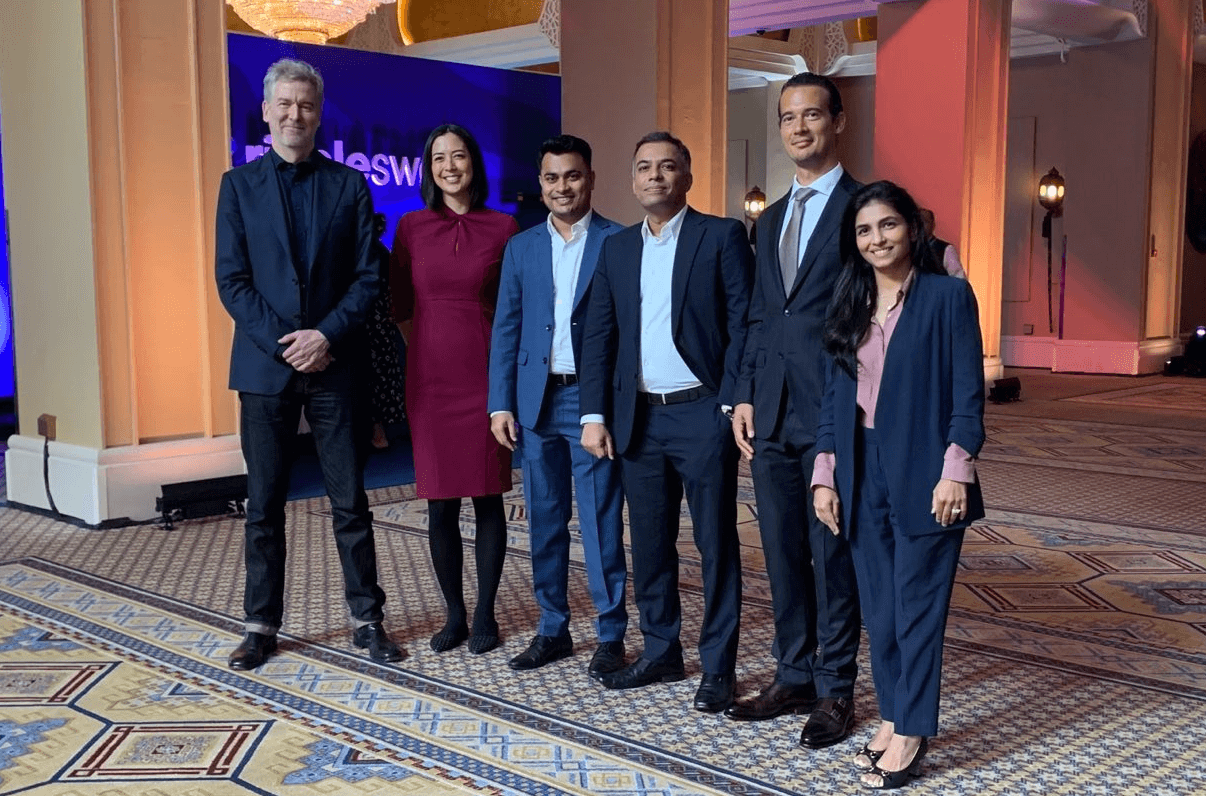

Picture taken at Ripple Swell Dubai, November 8, 2023. From left to right: Seamus Donoghue (Metaco); Monica Long (Ripple); Hashir Rahim (HSBC); Rajeev Tummala (HSBC); Adrien Treccani (Metaco); Ussrah Hussain (HSBC)

– 08 November 2023 —

HSBC announced today that it plans to launch a new digital assets custody service for institutional clients who invest in tokenised securities.

Once live in 2024, HSBC’s new digital assets custody service will complement HSBC Orion, the bank’s platform for issuing digital assets, as well as HSBC’s recently launched offering for tokenised physical gold. Together, these form a complete digital asset offering for HSBC’s institutional clients.

HSBC is working with Swiss enterprise tech firm, Metaco, to use its institutional platform, Harmonize, as part of HSBC’s new custody service for digital assets. Metaco’s Harmonize solution helps unify security and management of digital asset operations.

The full press release is available for download at the following link [opens PDF in new page].

####

About HSBC

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of $3,021bn at 30 September 2023, HSBC is one of the world’s largest banking and financial services organisations.

About Metaco

Founded in 2015 in Switzerland, Metaco is an enterprise technology company whose mission is to enable financial and non-financial institutions to securely build their digital asset operations. The company’s core product, Harmonize™, is a mission-critical orchestration platform for digital assets. From asset-agnostic custody and trading to tokenization, staking and smart contract management, the platform seamlessly connects institutions to the broad universe of decentralized finance (DeFi) and decentralized applications (Web3 Dapps). Metaco has established itself as the institutional standard for digital asset infrastructure, trusted by the world’s largest global custodians, banks, regulated exchanges, and corporates. Its software and technology solutions enable institutions to store, trade, issue and manage any type of digital asset — such as crypto and digital currencies, digital securities, and non-fungible tokens (NFTs) – with the highest possible security and agility. Metaco is part of Ripple, the leader in enterprise blockchain and crypto solutions.